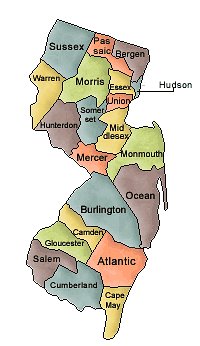

New Jersey and Counties

New Jersey Medicare Supplemental – New Jersey Medigap Plan

New Jersey is the Garden State

With a population of 8.9M

New Jersey is known for many things but this one is very interesting. It had the world’s first drive-in movie theater, built in 1933 near Camden

New Jersey Medicare Supplement Insurance and Medigap insurance are synonymous terms. Both refer to Medicare health insurance plans that have low out-of-pocket costs, allow you to choose your doctors and hospitals, allows your coverage to go with you anywhere in the country and is available by guaranteed issue when you are about to turn 65. Contact a Medicare insurance professional at Medicare Supplemental Advisors for more information on this unique enrollment period.

If you are already a New Jersey Senior then you can enter your zip code above to compare Medicare Insurance plans, premiums and benefits that you may be most appropriate for you. Medicare enrollment materials are available to be mailed at you upon request in the Enrollment section. Consult with a Medicare Supplemental Advisor for answers to your questions.

New Jersey Medicare Supplemental Insurance Plan Comparisons

New Jersey Seniors are eligible to compare Medicare premiums and switch their current Medicare Supplement plan to a new Medicare Supplement plan at any time during the year. As long as you can answer the health questions on the application then getting approved into a new plan is a way to reduce your premiums. Every year, some Medicare Advantage and Medicare prescription drug plans choose not to renew their existing Medicare contracts. If your Medicare Advantage Plan provider sent you a non-renewal notice this year, then that notice will serve you to enroll into a Medicare Supplement plan without having to answer health questions.

When to Enroll in a New Jersey Medicare Supplemental Insurance Plan?

You qualify for Part A, Hospital, when you or your spouse has worked for 40 quarters (ten years). Part B, Doctors, is provided to you at a monthly cost that increases for those in higher incomes. If you have not received anything in the mail then call Social Security for information at 1-800-772-1213. As long as you are eligible, you can enroll in Medicare Part A and Part B up to three months before and three months after your 65th birth month.

Some insurers allow you to apply for a Medicare Supplemental plan six months before your 65th birth month. During this initial enrollment period, you can not be denied coverage and will not have to answer any health questions. Although you will not receive your policy until you are covered under Medicare Part A and Part B, some insurers will still allow you to send you application and the insurer will lock your rate for the six months before your Part B effective date. For most, your Part B effective date is the 1st of the month of your birth month. For those born on the 1st of the month, then your Part B effective date is moved up to the 1stof the previous month.

New Jersey Medicare Supplement Excess Charges

Several states have mandated that Medicare providers are not able to charge more than what Medicare allows. That means that for those providers that accept Medicare cannot charge Excess Charges. The states include Connecticut, Massachusetts, Minnesota, Ohio, Pennsylvania, Rhode Island and Vermont. In all other states, including New Jersey, providers are able to bill up to 15% of what Medicare Allows directly to the Medicare Beneficiary (you). Medicare Supplement Insurance policyholders with Plans F and Plan G have coverage for Part B Excess Charges.

New Jersey Medicare Supplement Insurance Plan Standardization

In 1990, the Medicare Supplement Plans were standardized into 15 plans labeled Plan A through Plan L. Then in June of 2010, the Medicare Supplement Plans were “Modernized” to streamline under utilized benefits. Today, there are 10 plans labeled Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, Plan K, Plan L, Plan M and Plan N. All benefits have been standardized according to the plan letter. So even if you live in a different county or state, Plan F in Chester, New Jersey has the same benefits as Plan F in Cape May, New Jersey. Plan F is standardized across all states. Also the New Jersey Mutual of Omaha Plan F has the same benefits as the New Jersey AARP United Healthcare Plan F. A key differentiator is not always the premium that each company charges for their Plan F. It is whether or not that company has the financial stability to maintain that rate with modest increases. Talk to a Medicare Supplemental Advisor to discuss other important factors in selecting a health care company. Other providers of Medicare Supplemental Insurance plans include United of Omaha, Gerber Life, Blue Cross Blue Shield, Assured Life, Humana, New Era Life and Genworth.

New Jersey Medicare Part D Prescription Drug Coverage

While some New Jersey Medicare Advantage Plans have Part D Prescription Drug coverage included with the plan, Medicare Supplemental Plans do not. And even though you do not take prescription medicine, you may want to pick up a low cost Part D plan in order to have availability to lower cost prescription drugs when you need them. And, by enrolling in a Part D Plan when you are eligible, you will avoid penalties for not having a plan in the future. Please call Medicare Supplemental Advisors for more information on this subject.

One of the benefits of have a separate New Jersey Medicare Part D Prescription Drug Plan is to have the ability to calculate and compare the different drug formularies that have the lowest possible cost per year -based on your generic and/or brand name drugs that are specific to you. Not just the formulary that comes with a Medicare Advantage Plan. With a separate Part D plan, you can check every year during the annual open enrollment period which plan best for you and your current formulary. Contact us or complete the form in Part D with your prescription name and dose per day to get a list of approved Part D companies that best meet your prescription requirements. As part of our service to you, we will be happy to help you find a plan tailored to cover your prescription drug formulary.

Medicare Supplemental Advisors serve all of New Jersey including Middlesex, Monmouth, Hunterdon, Bergen, Morris, Essex, Ocean, Union, Hudson, Atlantic and Warren County, New Jersey. New Jersey Medicare enrollment is performed through a needs analysis of the New Jersey Medicare supplement insurance plans available in your area. Speak to a licensed Medicare advisor when enrolling into a New Jersey Medicare plan, or compare New Jersey Medicare Plans when looking for replacement. Always make sure that you have a complete and thorough understanding of NJ Medicare plans, premiums and benefits.

Medicare Supplemental Advisors is an independent broker agency specializing in Medicare Supplement, Dental, Vision, Hearing and Medicare Part D Insurance Plans and is not connected with or endorsed by the United States Government or with the Federal Medicare Program. Medicare beneficiaries are encouraged to seek professional advice from an independent licensed agent/broker that is authorized to provide multiple Medicare insurers before final Medicare plan enrollment. Call us today.