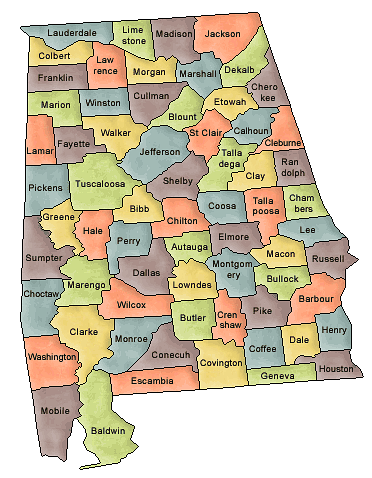

ALABAMA Medicare Plans – Alabama Medigap

The Yellow Hammer State

The Yellow Hammer State

Alabama has been known as the “Yellowhammer State” since the Civil War.

Named from Alabama River by early European explorers and named “Alibamu” after the local Indian tribe

George Washington Carver, who discovered more than 300 uses for peanuts

Population 4.8M

If your turning 65 your are eligible for Medicare…..

Medicare Supplement Insurance Plans also known as Medigap Plans Provide the Best and Most Comprehensive Coverages Including:

- No Out-Of-Pocket Costs.

- No Co-Payments for Doctors.

- No Referrals Necessary.

- No Deductibles for Hospitals.

- Choice of Any Doctor, Any Hospital, Any Medical Facility that accepts Medicare Anywhere in the United States.

- Coverage is Guaranteed Renewable which means your coverage cannot be denied as long as you continue to pay the premiums each year.

- Coverage goes with you when traveling, moving or selecting a doctor anywhere in the United States.

- Ask us about Medigap Plan F if you just want the best, most comprehensive healthcare plan.

A Medicare supplement insurance plan helps cover the “gaps” in coverage that are left unpaid after original Medicare pays its portion of your health care expenses. For this reason, these plans are often referred to as Medigap plans, Medicare Supplemental Insurance or Med Supp. Medicare Supplement plan and Medigap plan are synonymous and will be used interchangeably in discussion.

Medicare Advantage Plans are health plans approved by the federal government and run by private companies. These plans are also sometimes referred to as Medicare Part C. Medicare Advantage Plans are not supplemental insurance and must follow rules set by Medicare.

Medicare Advantage Plans will provide benefits at least equal to those in Medicare Part A – Hospital and Medicare Part B – Medical. Medicare Advantage Plans may have different doctor co-payments, hospital coinsurance, and deductibles for than original Medicare coverage. Key differentiators plans are the maximum out-of-pocket expenses that could possibly occur in a twelve (12) month period, current doctor’s network and your current formulary of prescriptions supported in the plan. These three (3) areas are recommended to be confirmed before final selection of any advantage plan.